Most of them might know this concept, yet I would like to share few thoughts about this effect. Most of them, might have heard this term while watching some movies. In accordance with the chaos theory, the phenomenon where a minute localized change in a complex system can have a large effect in somewhere. It was originated in the year 1980, from the notion in the chaos theory, a butterfly fluttering in Rio de janerio could change the weather in another place like Chicago.

Initially, this term was majorly used in weather prediction, later it was used as a metaphor in science. The name was coined by edward lorenz. It plays a major role in weather and quantum mechanics. The real time example of tornado being influenced by minor perturbations such as flapping of the wings of distant butterfly several weeks earlier. He discovered the effect when he observed that runs of his weather model with initial condition data that was rounded in seemingly inconsequential manner.

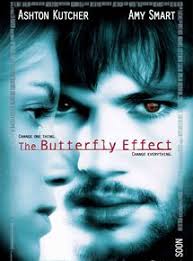

It would fail to reproduce the results of runs with the unrounded initial condition data. A very small change in initial conditions had created a significantly different outcome.It can also be used in simple systems, randomness of throwing outcomes of dice, depends on the characteristic to amplify small differences in the initial conditions. which makes it virtually impossible to throw the dice exactly the same way twice. A movie was taken in the year 2004 based on this concept.

Initially, this term was majorly used in weather prediction, later it was used as a metaphor in science. The name was coined by edward lorenz. It plays a major role in weather and quantum mechanics. The real time example of tornado being influenced by minor perturbations such as flapping of the wings of distant butterfly several weeks earlier. He discovered the effect when he observed that runs of his weather model with initial condition data that was rounded in seemingly inconsequential manner.

It would fail to reproduce the results of runs with the unrounded initial condition data. A very small change in initial conditions had created a significantly different outcome.It can also be used in simple systems, randomness of throwing outcomes of dice, depends on the characteristic to amplify small differences in the initial conditions. which makes it virtually impossible to throw the dice exactly the same way twice. A movie was taken in the year 2004 based on this concept.

Comments

Post a Comment